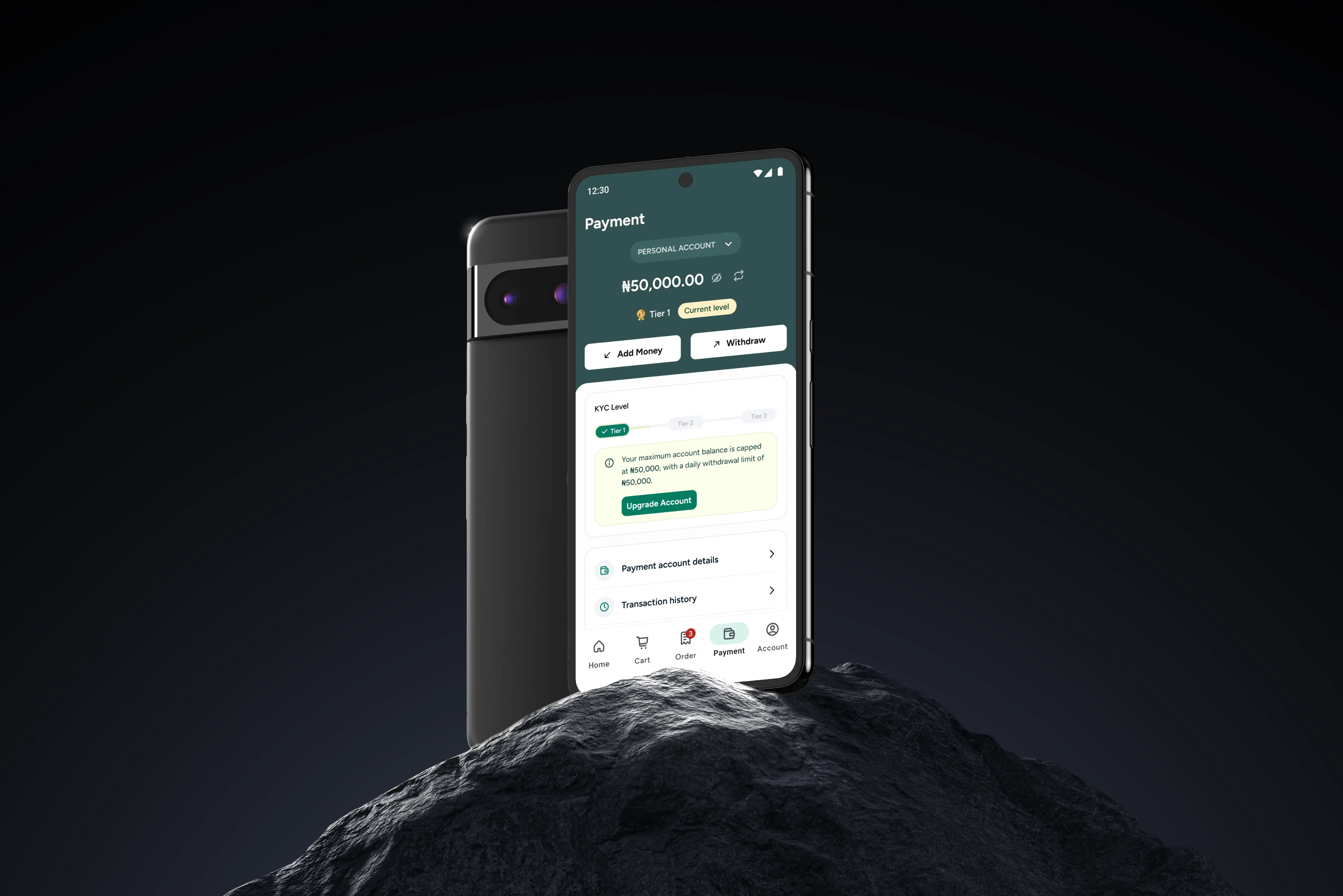

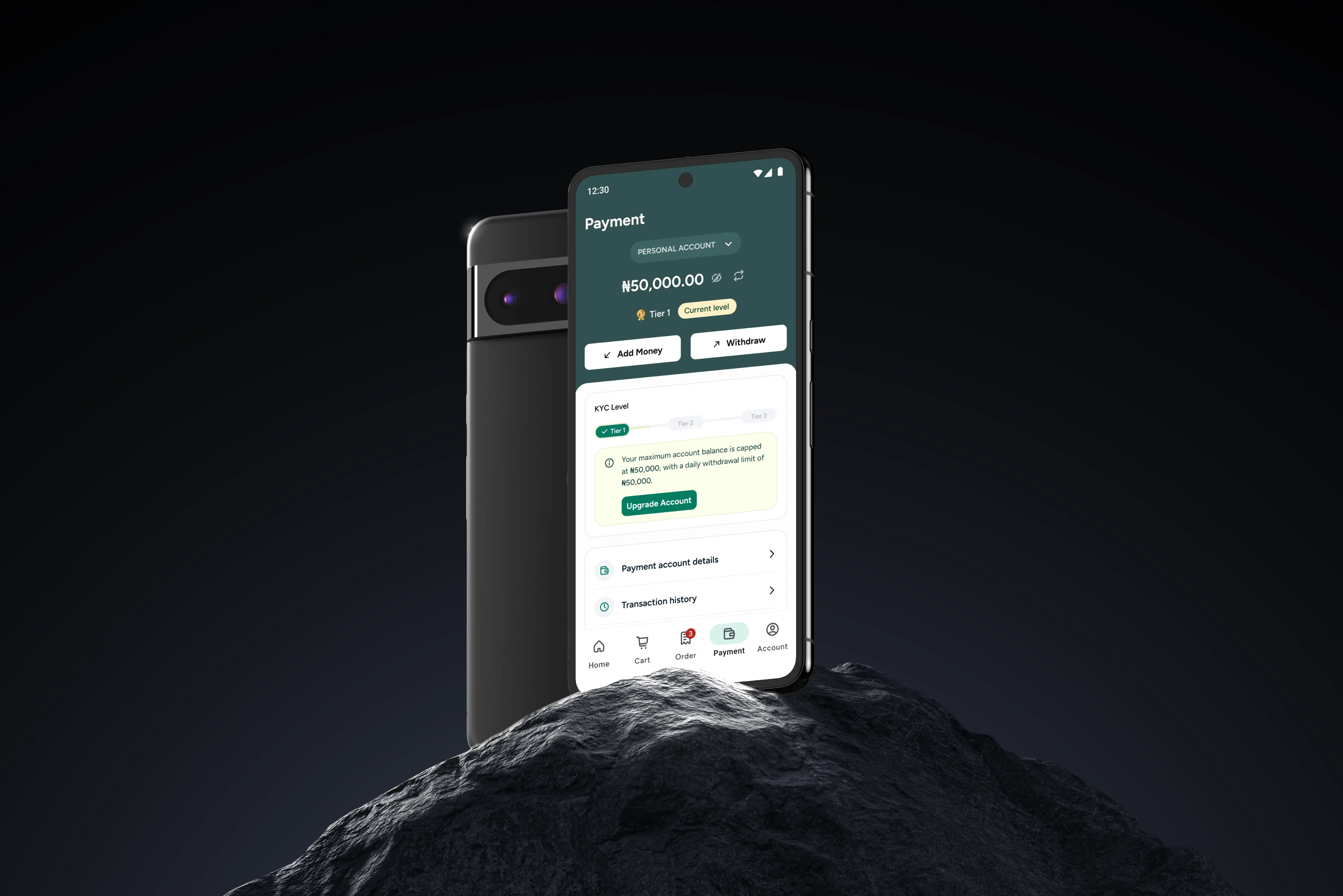

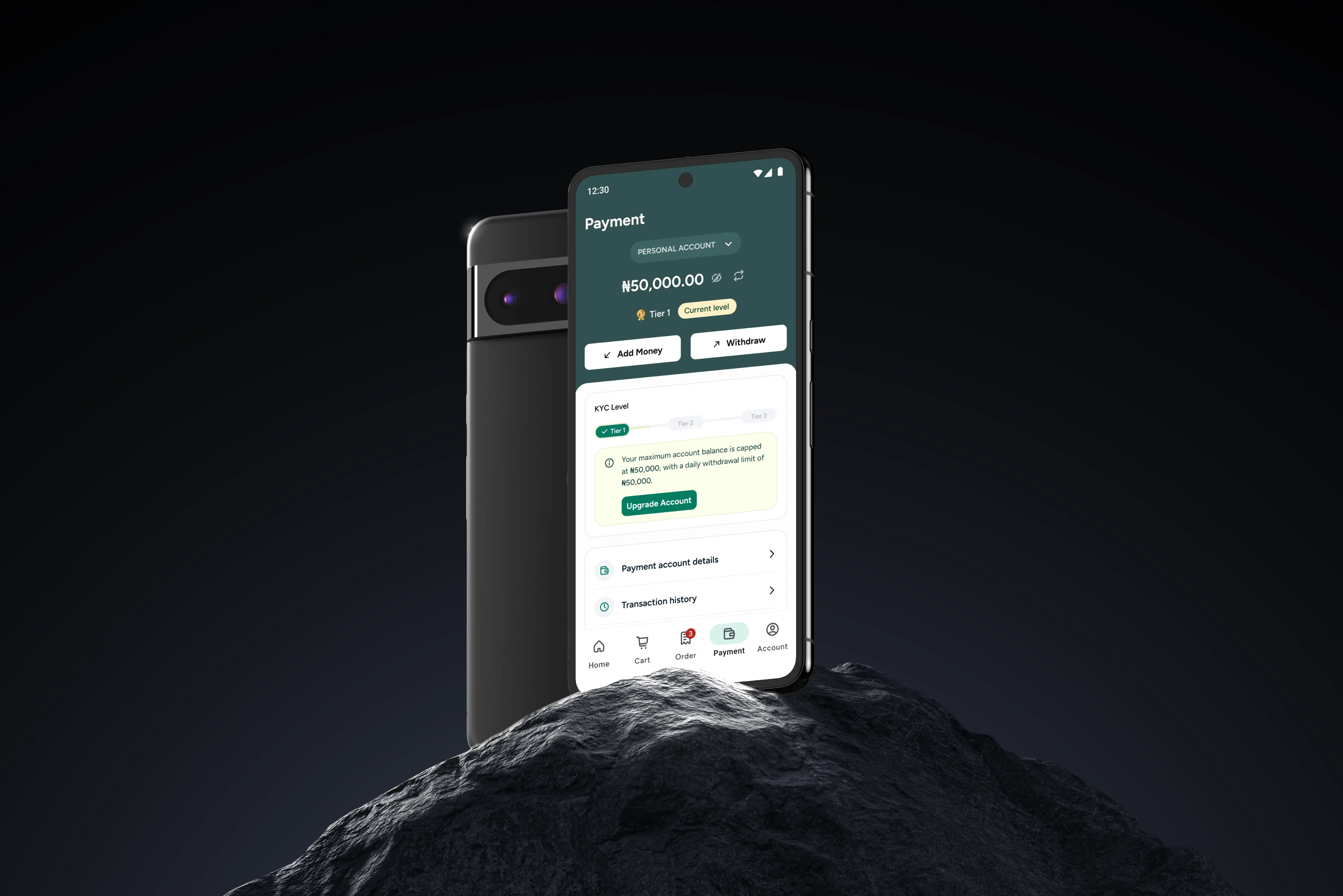

Sabi Market payment account

From payment fragmentation to financial inclusion: Designing Sabi's native payment system for Africa's underserved SME market"

Home

My Role

Discovery, Visual & Product Design,

UX Research, Prototyping

Team

Bolu Obisanya, Product Designer

and other Stakeholders; Engineering, Product,

Year

2025

I contributed to the end-to-end design of Sabi’s Payment Account experience, helping users unlock business tools like loans, transfers, and POS tracking through seamless account activation. I worked closely with Engineering and LRC to streamline onboarding and drive adoption—helping grow account openings by over 100% in 3 months.

Context

An opportunity to bridge financial gaps

Sabi Market is an FMCG-focused eCommerce platform serving manufacturers, wholesalers (sellers), and retailers (buyers). While the platform offered digital ordering and payments through cards, USSD, and bank transfers, we faced increasing friction as user volume and order complexity grew.

"Sabi was growing fast — but payments and refunds weren’t keeping up."

As we scaled, our legacy payment integrations started breaking under the weight of regulatory limits, refund challenges, and manual reconciliation efforts. Sellers weren't being paid fast enough. Buyers were struggling with payment failures and refund bottlenecks. The opportunity? Build a secure, flexible, and scalable Wallet (Payment Account) system that works for both sides of our marketplace

Problem

Financial exclusion in a growing market

The existing payment landscape presented multifaceted challenges that demanded comprehensive solutions:

Refund failure & regulatory limits — CBN-imposed transaction limits made it hard to process high-value FMCG orders. Failed deliveries led to difficult refunds, straining support teams and customer trust.

Manual seller reconciliation — As sellers grew, our manual payout process became chaotic — tracking successful deliveries and disbursing funds created operational lag and errors.

Fragmented payment experience — Buyers had multiple payment options, but none of them supported order splitting, payment visibility, or escrow logic that guarantees fairness for sellers.

Challenge

Design a reliable, intuitive Wallet system for both buyers and sellers to power large transactions, ensure easy refunds, and unlock scalable seller reconciliation — all while navigating identity verification (KYC) in a region with both formal and informal businesses.

Growing pains

Financial Fragmentation

We ran interviews and in-field observations with:

Retailers in informal markets — Who prefer USSD and cash but are open to Wallets if refunds are easy and secure.

Wholesalers & distributors — Who manage hundreds of SKUs and demand transparency on when and how they'll be paid.

Internal teams — Who revealed how much support effort went into refunds, payout errors, and payment delays.

Painpoints

As our marketplace expanded, users encountered increasingly complex challenges with the existing payment infrastructure that demanded immediate attention

70% of retailers don’t have registered businesses

Sellers want real-time access to pending balances

Buyers want refund assurance when items go undelivered

Manual reconciliation takes ~3 hours/day

Patching things up

To address these core challenges without compromising regulatory compliance, we needed to architect a comprehensive system that would

Break down verification into manageable, user-friendly steps

Show escrowed balances & when funds become available

Wallet refunds should be instant & automatic

Automate payout logic tied to delivery status

Design principles

Trust through clarity — Let users clearly see balances, limits, and refund statuses.

One wallet, many possibilities — Seamless use across checkout, refunds, and withdrawals.

Tiered simplicity — Support formal and informal users without breaking the flow.

The wallet experience

SABI PAYMENT SYSTEM (NEW)

Progressive Verification Framework

Rather than presenting verification as an overwhelming, monolithic hurdle, we strategically broke the process into discrete, manageable steps that users could navigate with confidence:

1

Basic identity verification seamlessly collected during initial onboarding

2

BVN/NIN verification enhanced with built-in lookup assistance for user convenience

3

Photo verification utilizing advanced liveness detection technology

4

Additional documentation requirements based on specific account tier progression

UNREGISTERED BUSINESS FLOW

Tiered Account Structure

We implemented three progressive tiers within each account type to strategically balance regulatory requirements with user accessibility and growth

Each tier requires incremental additional verification but unlocks significantly greater functionality and higher limits, creating clear incentives for users to progress through verification milestones.

1

Tier 1: ₦50,000 - Essential basic transfers and standard payments

2

Tier 2: ₦200,000+ - Advanced recurring payments and partial refund capabilities

4

Tier 3: ₦1,000,000+ - Premium credit facilities and bulk payment processing

TIERED ACCOUNT STRUCTURE

Core Account Functionality

We strategically prioritized six essential features based on comprehensive user needs analysis and observed financial behaviors:

Account Dashboard — Comprehensive balance overview with intuitive quick actions

Complex verification barriers — 82% of businesses reported abandoning financial service applications due to overwhelming documentation requirements, creating significant friction in user acquisition.

Withdrawal Account Setup — Streamlined process to link external accounts for seamless funds transfer

Transaction PIN — Enhanced multi-layer security for payment authorization and fraud prevention

Add Money — Multiple convenient funding options including bank transfer, QR code scanning, and more

Withdraw Money — Efficient, transparent process for moving funds out of the ecosystem when needed

CORE FUNCTIONALITIES

Checkout Integration

We seamlessly integrated payment accounts into the existing checkout experience to ensure natural adoption and minimize user friction:

Payment method selection prominently includes Sabi payment account options

One-click payment functionality directly from available account balance

Intelligent routing between personal and business accounts based on transaction context and user behavior

Comprehensive fallback options when account balance is insufficient for transaction completion

CHECKOUT INTEGRATION

Next up

Validating our decisions with our customers

As we move from design to validation, the next step is to put the payment system in the hands of the people it’s built for. We’re preparing to run usability testing sessions with Sabi Market’s customers—from micro-retailers in local markets to large-scale distributors. We will observe how real users navigate payment tasks, uncover friction points, and validate the intuitiveness of our flows.

These insights will shape the next iteration of the experience, ensuring it aligns tightly with the daily realities, expectations, and financial habits of Africa’s informal economy.

Up Next: Merit Circle Staking

Sabi Market payment account

From payment fragmentation to financial inclusion: Designing Sabi's native payment system for Africa's underserved SME market"

Home

My Role

Discovery, Visual & Product Design,

UX Research, Prototyping

Team

Bolu Obisanya, Product Designer

and other Stakeholders; Engineering, Product,

Year

2025

I contributed to the end-to-end design of Sabi’s Payment Account experience, helping users unlock business tools like loans, transfers, and POS tracking through seamless account activation. I worked closely with Engineering and LRC to streamline onboarding and drive adoption—helping grow account openings by over 100% in 3 months.

Context

An opportunity to bridge financial gaps

Sabi Market is an FMCG-focused eCommerce platform serving manufacturers, wholesalers (sellers), and retailers (buyers). While the platform offered digital ordering and payments through cards, USSD, and bank transfers, we faced increasing friction as user volume and order complexity grew.

"Sabi was growing fast — but payments and refunds weren’t keeping up."

As we scaled, our legacy payment integrations started breaking under the weight of regulatory limits, refund challenges, and manual reconciliation efforts. Sellers weren't being paid fast enough. Buyers were struggling with payment failures and refund bottlenecks. The opportunity? Build a secure, flexible, and scalable Wallet (Payment Account) system that works for both sides of our marketplace

Problem

Financial exclusion in a growing market

The existing payment landscape presented multifaceted challenges that demanded comprehensive solutions:

Refund failure & regulatory limits — CBN-imposed transaction limits made it hard to process high-value FMCG orders. Failed deliveries led to difficult refunds, straining support teams and customer trust.

Manual seller reconciliation — As sellers grew, our manual payout process became chaotic — tracking successful deliveries and disbursing funds created operational lag and errors.

Fragmented payment experience — Buyers had multiple payment options, but none of them supported order splitting, payment visibility, or escrow logic that guarantees fairness for sellers.

Challenge

Design a reliable, intuitive Wallet system for both buyers and sellers to power large transactions, ensure easy refunds, and unlock scalable seller reconciliation — all while navigating identity verification (KYC) in a region with both formal and informal businesses.

Growing pains

Financial Fragmentation

We ran interviews and in-field observations with:

Retailers in informal markets — Who prefer USSD and cash but are open to Wallets if refunds are easy and secure.

Wholesalers & distributors — Who manage hundreds of SKUs and demand transparency on when and how they'll be paid.

Internal teams — Who revealed how much support effort went into refunds, payout errors, and payment delays.

Painpoints

As our marketplace expanded, users encountered increasingly complex challenges with the existing payment infrastructure that demanded immediate attention

70% of retailers don’t have registered businesses

Sellers want real-time access to pending balances

Buyers want refund assurance when items go undelivered

Manual reconciliation takes ~3 hours/day

Patching things up

To address these core challenges without compromising regulatory compliance, we needed to architect a comprehensive system that would

Break down verification into manageable, user-friendly steps

Show escrowed balances & when funds become available

Wallet refunds should be instant & automatic

Automate payout logic tied to delivery status

Design principles

Trust through clarity — Let users clearly see balances, limits, and refund statuses.

One wallet, many possibilities — Seamless use across checkout, refunds, and withdrawals.

Tiered simplicity — Support formal and informal users without breaking the flow.

The wallet experience

SABI PAYMENT SYSTEM (NEW)

Progressive Verification Framework

Rather than presenting verification as an overwhelming, monolithic hurdle, we strategically broke the process into discrete, manageable steps that users could navigate with confidence:

1

Basic identity verification seamlessly collected during initial onboarding

2

BVN/NIN verification enhanced with built-in lookup assistance for user convenience

3

Photo verification utilizing advanced liveness detection technology

4

Additional documentation requirements based on specific account tier progression

UNREGISTERED BUSINESS FLOW

Tiered Account Structure

We implemented three progressive tiers within each account type to strategically balance regulatory requirements with user accessibility and growth

Each tier requires incremental additional verification but unlocks significantly greater functionality and higher limits, creating clear incentives for users to progress through verification milestones.

1

Tier 1: ₦50,000 - Essential basic transfers and standard payments

2

Tier 2: ₦200,000+ - Advanced recurring payments and partial refund capabilities

4

Tier 3: ₦1,000,000+ - Premium credit facilities and bulk payment processing

TIERED ACCOUNT STRUCTURE

Core Account Functionality

We strategically prioritized six essential features based on comprehensive user needs analysis and observed financial behaviors:

Account Dashboard — Comprehensive balance overview with intuitive quick actions

Complex verification barriers — 82% of businesses reported abandoning financial service applications due to overwhelming documentation requirements, creating significant friction in user acquisition.

Withdrawal Account Setup — Streamlined process to link external accounts for seamless funds transfer

Transaction PIN — Enhanced multi-layer security for payment authorization and fraud prevention

Add Money — Multiple convenient funding options including bank transfer, QR code scanning, and more

Withdraw Money — Efficient, transparent process for moving funds out of the ecosystem when needed

CORE FUNCTIONALITIES

Checkout Integration

We seamlessly integrated payment accounts into the existing checkout experience to ensure natural adoption and minimize user friction:

Payment method selection prominently includes Sabi payment account options

One-click payment functionality directly from available account balance

Intelligent routing between personal and business accounts based on transaction context and user behavior

Comprehensive fallback options when account balance is insufficient for transaction completion

CHECKOUT INTEGRATION

Next up

Validating our decisions with our customers

As we move from design to validation, the next step is to put the payment system in the hands of the people it’s built for. We’re preparing to run usability testing sessions with Sabi Market’s customers—from micro-retailers in local markets to large-scale distributors. We will observe how real users navigate payment tasks, uncover friction points, and validate the intuitiveness of our flows.

These insights will shape the next iteration of the experience, ensuring it aligns tightly with the daily realities, expectations, and financial habits of Africa’s informal economy.

Up Next: Merit Circle Staking

Coming Soon

Sabi Market payment account

From payment fragmentation to financial inclusion: Designing Sabi's native payment system for Africa's underserved SME market"

Home

My Role

Discovery, Visual & Product Design,

UX Research, Prototyping

Team

Bolu Obisanya, Product Designer

and other Stakeholders; Engineering, Product,

Year

2025

I contributed to the end-to-end design of Sabi’s Payment Account experience, helping users unlock business tools like loans, transfers, and POS tracking through seamless account activation. I worked closely with Engineering and LRC to streamline onboarding and drive adoption—helping grow account openings by over 100% in 3 months.

Context

An opportunity to bridge financial gaps

Sabi Market is an FMCG-focused eCommerce platform serving manufacturers, wholesalers (sellers), and retailers (buyers). While the platform offered digital ordering and payments through cards, USSD, and bank transfers, we faced increasing friction as user volume and order complexity grew.

"Sabi was growing fast — but payments and refunds weren’t keeping up."

As we scaled, our legacy payment integrations started breaking under the weight of regulatory limits, refund challenges, and manual reconciliation efforts. Sellers weren't being paid fast enough. Buyers were struggling with payment failures and refund bottlenecks. The opportunity? Build a secure, flexible, and scalable Wallet (Payment Account) system that works for both sides of our marketplace

Problem

Financial exclusion in a growing market

The existing payment landscape presented multifaceted challenges that demanded comprehensive solutions:

Refund failure & regulatory limits — CBN-imposed transaction limits made it hard to process high-value FMCG orders. Failed deliveries led to difficult refunds, straining support teams and customer trust.

Manual seller reconciliation — As sellers grew, our manual payout process became chaotic — tracking successful deliveries and disbursing funds created operational lag and errors.

Fragmented payment experience — Buyers had multiple payment options, but none of them supported order splitting, payment visibility, or escrow logic that guarantees fairness for sellers.

Challenge

Design a reliable, intuitive Wallet system for both buyers and sellers to power large transactions, ensure easy refunds, and unlock scalable seller reconciliation — all while navigating identity verification (KYC) in a region with both formal and informal businesses.

Growing pains

Financial Fragmentation

We ran interviews and in-field observations with:

Retailers in informal markets — Who prefer USSD and cash but are open to Wallets if refunds are easy and secure.

Wholesalers & distributors — Who manage hundreds of SKUs and demand transparency on when and how they'll be paid.

Internal teams — Who revealed how much support effort went into refunds, payout errors, and payment delays.

Painpoints

As our marketplace expanded, users encountered increasingly complex challenges with the existing payment infrastructure that demanded immediate attention

70% of retailers don’t have registered businesses

Sellers want real-time access to pending balances

Buyers want refund assurance when items go undelivered

Manual reconciliation takes ~3 hours/day

Patching things up

To address these core challenges without compromising regulatory compliance, we needed to architect a comprehensive system that would

Break down verification into manageable, user-friendly steps

Show escrowed balances & when funds become available

Wallet refunds should be instant & automatic

Automate payout logic tied to delivery status

Design principles

Trust through clarity — Let users clearly see balances, limits, and refund statuses.

One wallet, many possibilities — Seamless use across checkout, refunds, and withdrawals.

Tiered simplicity — Support formal and informal users without breaking the flow.

The wallet experience

SABI PAYMENT SYSTEM (NEW)

Progressive Verification Framework

Rather than presenting verification as an overwhelming, monolithic hurdle, we strategically broke the process into discrete, manageable steps that users could navigate with confidence:

1

Basic identity verification seamlessly collected during initial onboarding

2

BVN/NIN verification enhanced with built-in lookup assistance for user convenience

3

Photo verification utilizing advanced liveness detection technology

4

Additional documentation requirements based on specific account tier progression

ACTIVATION FLOW

Tiered Account Structure

We implemented three progressive tiers within each account type to strategically balance regulatory requirements with user accessibility and growth

Each tier requires incremental additional verification but unlocks significantly greater functionality and higher limits, creating clear incentives for users to progress through verification milestones.

1

Tier 1: ₦50,000 - Essential basic transfers and standard payments

2

Tier 2: ₦200,000+ - Advanced recurring payments and partial refund capabilities

4

Tier 3: ₦1,000,000+ - Premium credit facilities and bulk payment processing

TIERED ACCOUNT STRUCTURE

Core Account Functionality

We strategically prioritized six essential features based on comprehensive user needs analysis and observed financial behaviors:

Account Dashboard — Comprehensive balance overview with intuitive quick actions

Transaction History — Advanced searchable, filterable record of all account activities

Withdrawal Account Setup — Streamlined process to link external accounts for seamless funds transfer

Transaction PIN — Enhanced multi-layer security for payment authorization and fraud prevention

Add Money — Multiple convenient funding options including bank transfer, QR code scanning, and more

Withdraw Money — Efficient, transparent process for moving funds out of the ecosystem when needed

CORE FUNCTIONALITIES

Checkout Integration

We seamlessly integrated payment accounts into the existing checkout experience to ensure natural adoption and minimize user friction:

Payment method selection prominently includes Sabi payment account options

One-click payment functionality directly from available account balance

Intelligent routing between personal and business accounts based on transaction context and user behavior

Comprehensive fallback options when account balance is insufficient for transaction completion

CHECKOUT INTEGRATION

Next up

Validating our decisions with our customers

As we move from design to validation, the next step is to put the payment system in the hands of the people it’s built for. We’re preparing to run usability testing sessions with Sabi Market’s customers—from micro-retailers in local markets to large-scale distributors. We will observe how real users navigate payment tasks, uncover friction points, and validate the intuitiveness of our flows.

These insights will shape the next iteration of the experience, ensuring it aligns tightly with the daily realities, expectations, and financial habits of Africa’s informal economy.

Up Next: Merit Circle Staking